Specializing in Quant Analytics for Low Latency Interest Rate Markets

SSRN Author Rank

410 out of 2,180,740

Welcome to my Quant Research page, a dedicated space where I share my published and working papers, technical notes, and practical resources from my career in quantitative finance. Drawing on extensive experience as a quant manager and executive director at leading investment banks, I aim to bridge rigorous financial theory with real-world application.

Here you’ll find direct links to my research, supporting materials such as Excel workbooks, and supplementary code examples designed to help fellow professionals, students, and enthusiasts deepen their understanding of advanced pricing models, risk analytics, and algorithmic trading strategies.

Whether you’re exploring structured products, statistical arbitrage, or the latest innovations in financial engineering, this page serves as a comprehensive hub for actionable quant insights and tools.

My AlgoQuantHub newsletter, AQH Weekly Deep Dive for algo trading and quant reasearch includes the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice.

Links to Quant Research

As a Quantitative Analyst and Researcher, I have worked on a wide range of projects at the intersection of mathematical modelling, pricing, risk analytics, and algorithmic trading. My experience spans the development and implementation of advanced quantitative models, trading strategies, and software solutions for financial markets.

SSRN Quant Articles, Papers & Slides

GitHub Quant Research

My research papers span a wide range of categories including mathematical modelling for quantitative finance, financial markets, algorithmic trading, machine learning, financial strategy, project finance and M&A. They are practical and place a strong emphasis on implementation, and showcase models and techniques designed to create a competitive edge in live trading environments.

Research topics include:

- Martingale Methods & Change of Measure

- Interest Rate Modelling & Convexity Adjustments

- Advanced Yield Curve Calibration & Optimization Techniques

- Automatic Adjoint Differentiation (AAD)

- Machine Learning and Algorithmic Trading Strategies

- Machine Earning – Algorithmic Trading Strategies

- Corporate & Project Finance Valuation Techniques

- Project Finance Strategies for Superior Growth & Competitive Advantage

Excel Workbooks, Training & Support Materials

Research papers are prototyped and implemented in a rigorous, test-driven environment, with solutions developed using Excel, Python, and C++. This approach ensures robust validation and practical applicability of quantitative models and techniques.

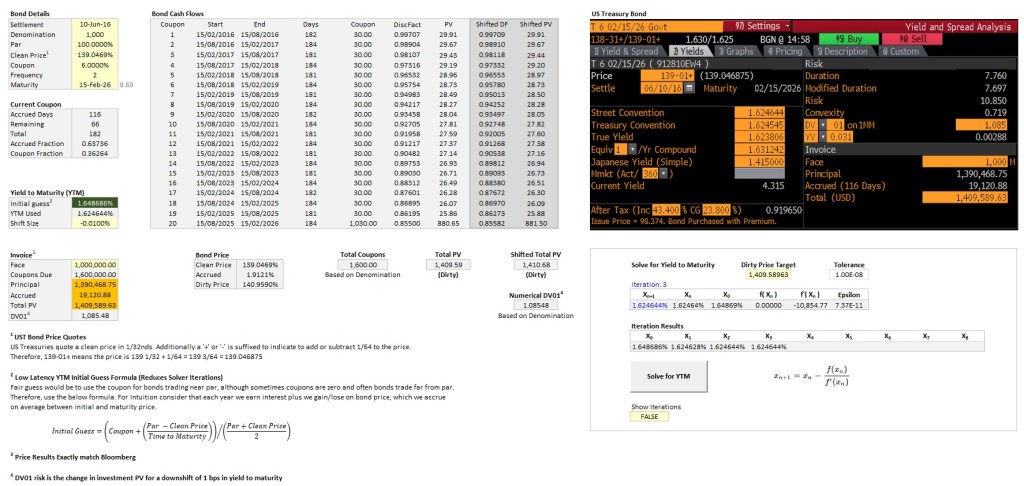

Example: US Treasury Bond Excel Workbook

This Excel spreadsheet demonstrates how to price a US Treasury Bond and exactly match live tradable Bond price shown in Bloomberg. Using a live market example we also compute the accrued interest, clean- and dirty price of a US treasury bond. We also show how to solve for its yield to maturity and compute the present value of the bond cash flows.

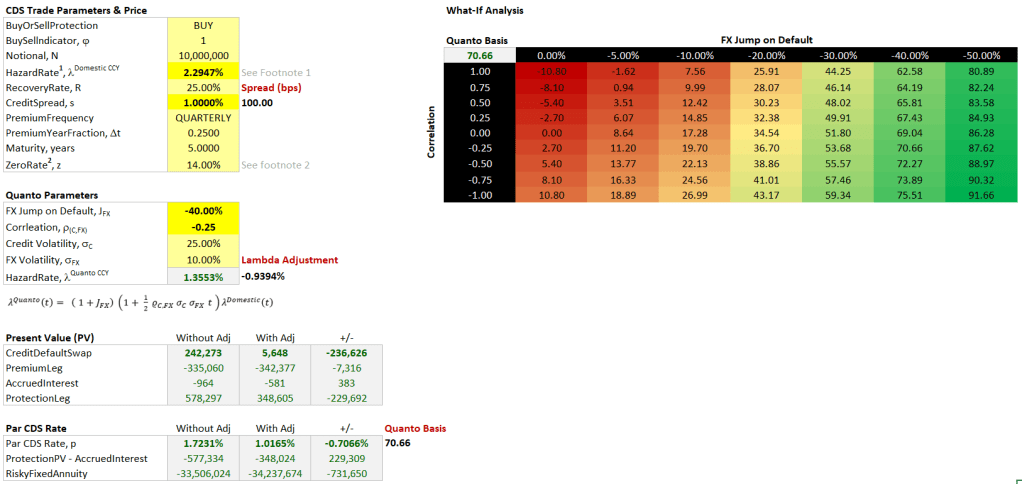

Example: Quanto CDS Excel Workbook

This exciting financial training guide and Excel workbook delves into the complex world of Quanto Credit Default Swaps (CDS), exploring their theory, pricing, and practical application through intriguing case studies. Quanto CDS has gained significant attention in recent times due to regulatory changes allowing such transactions for the first time in emerging markets such as Brazil.

Top Quant Papers

- Machine Earning – Algorithmic Trading Strategies for Superior Growth, Outperformance and Competitive Advantage

- Advanced Yield Curve Calibration, Mixed Interpolation Schemes & How to Incorporate Jumps and the Turn-of-Year Effect

- Low Latency Interest Rate Markets – Theory, Pricing & Practice

- Algorithmic Differentiation Cheat Sheet

- Cross Currency Swap Theory & Practice – An Illustrated Step-by-Step Guide of How to Price Cross Currency Swaps and Calculate the Basis Spread

- Quanto Credit Default Swaps Theory, Pricing & Practice

- Understanding Bonds, Pricing and the Risks ‘My Name Is Bond, James Bond’

- Bond Total Return Swaps – Theory, Pricing & Practice

- Martingale Measures & Change of Measure Explained

- Interest Rate Swaptions – A Review & Derivation of Swaption Pricing Formulae

- Exotic Option Pricing using Heston Simulation